Organisations | Resources | Certificate of Identity Form & User Guide

Certificate of Identity Form

This form is for CDF Cheque account signatories who require identification for NAB cheque link accounts.

You will need 100 points of Identification to complete the process.

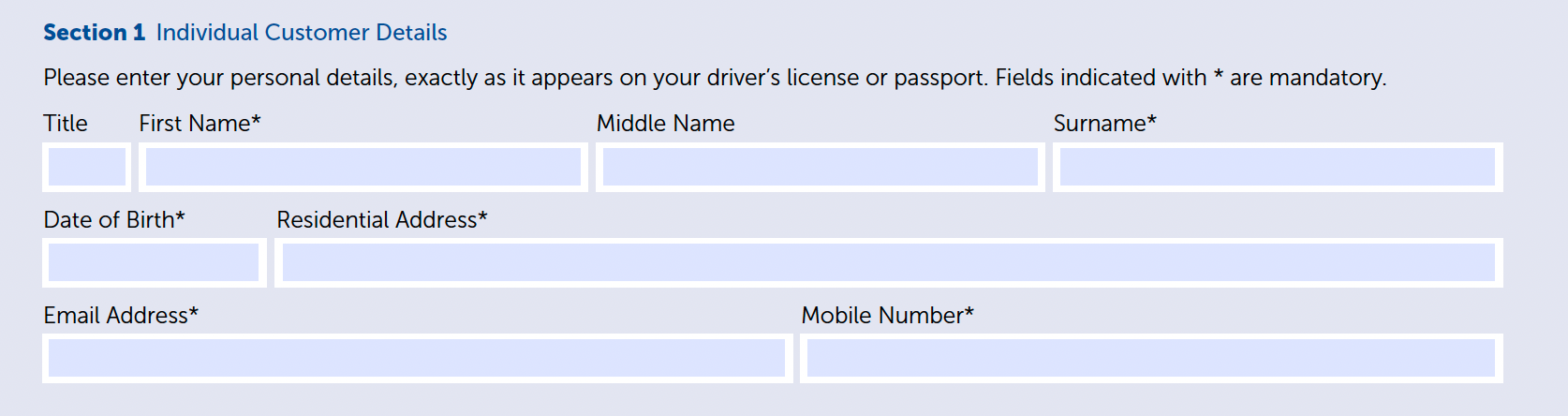

Step 1: Individual customer details

Complete the following mandatory fields in full. Enter your full name, exactly as it appears on your ID documents:

- Title: (Dr, Fr, Mr, Ms, Mrs, Miss, Rev)

- First Name

- Middle Name (if applicable)

- Surname

- Date of Birth (dd/mm/yyyy)

- Residential Address: Street Number & Street Name, Suburb, State & Postcode

- Email Address

- Mobile Number

Important information

- Enter your full legal name, exactly as it appears on your identification documents.

- Do not include nicknames, aliases or shortened versions of your name

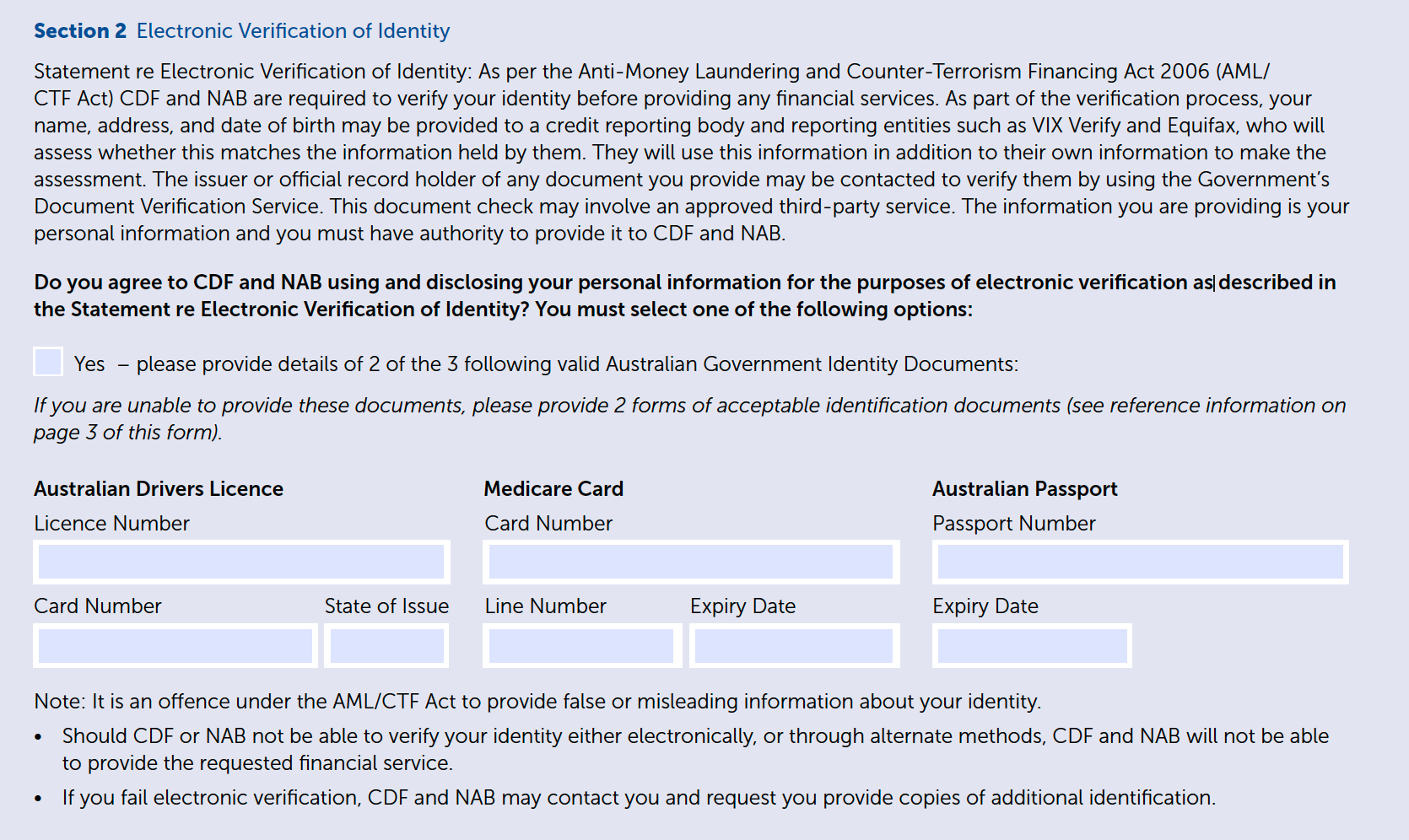

Step 2: Electronic verification of identity

CDF requires all signatories to be fully identified, using electronic verification of identity.

Australian Drivers Licence

- Licence Number (located on the front of your licence)

- Card Number (located on the back of your licence)

- State of Issue

Medicare Card

- Card Number (10 digit number)

- Line Number (the number of the line your name appears on)

- Expiry Date (mm/yyyy)

Australian Passport

- Passport Number (document number)

- Expiry Date (dd/mm/yyyy)

- **A passport expired in the past 2 years is acceptable

Important information

- Enter identification details exactly as they appear on your ID documents.

- Complete all fields related to the ID type you have selected.

- Click here for guidance on CDFs Electronic Verification of Identity Statement

- Click here for guidance on locating your driver’s licence card number for all States & Territories

- If unable to supply 2 of the preferred identification documents, please provide 2 certified documents as per the guideline on page 3 of the CDF/NAB Identity Form.

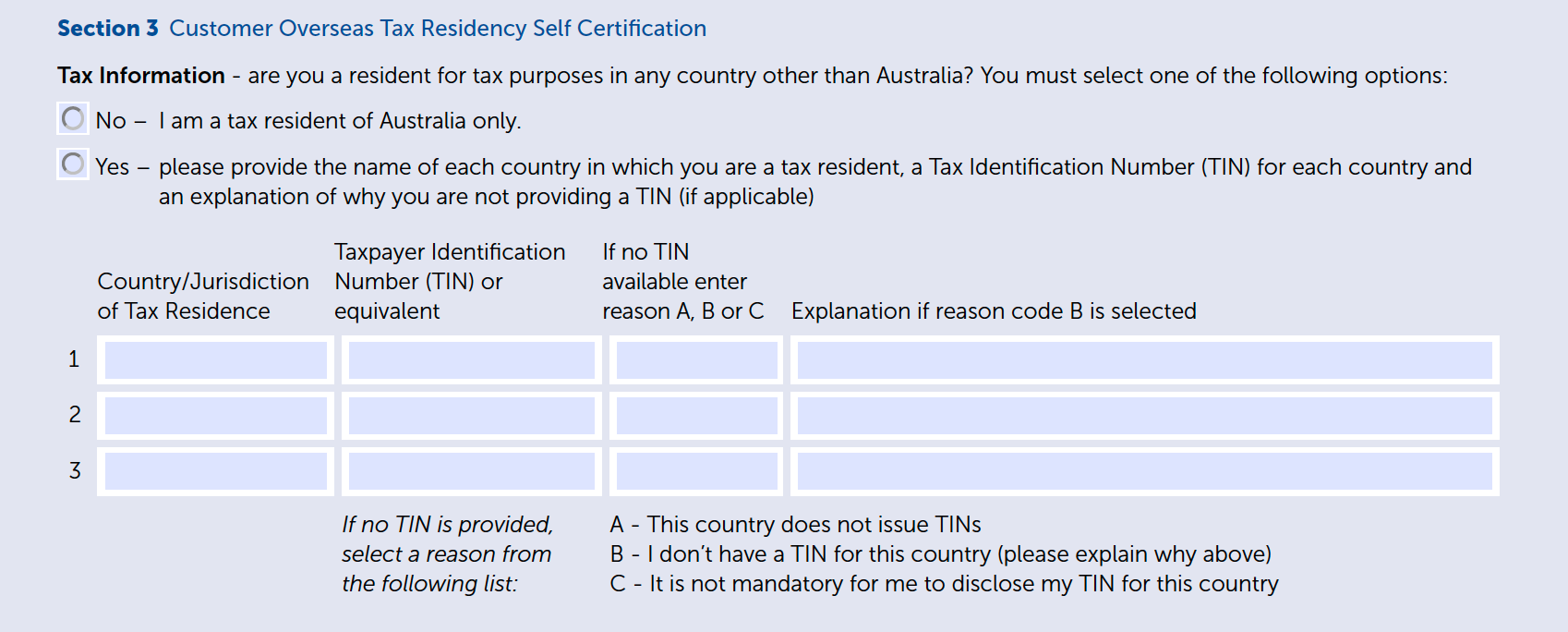

Step 3: Customer overseas tax residency self certification

Under the Taxation Administration Act (1953), CDF is required to ask customers about their tax details. CDF will ask you questions about your local and overseas tax obligations.

- Select NO if you are only a tax resident in Australia

- Select YES if you are a tax resident in any country other than Australia

If you select YES - complete the following details:

- Country/jurisdiction of tax residence

- TIN

- No TIN - enter reason code

- Enter explanation if required

Important information

- Click here for guidance on CDFs Foreign Account Tax Compliance Act (FATCA) and Common Reporting Standard (CRS) Statement

- For further guidance, please consult your accountant or refer to the ATO website.

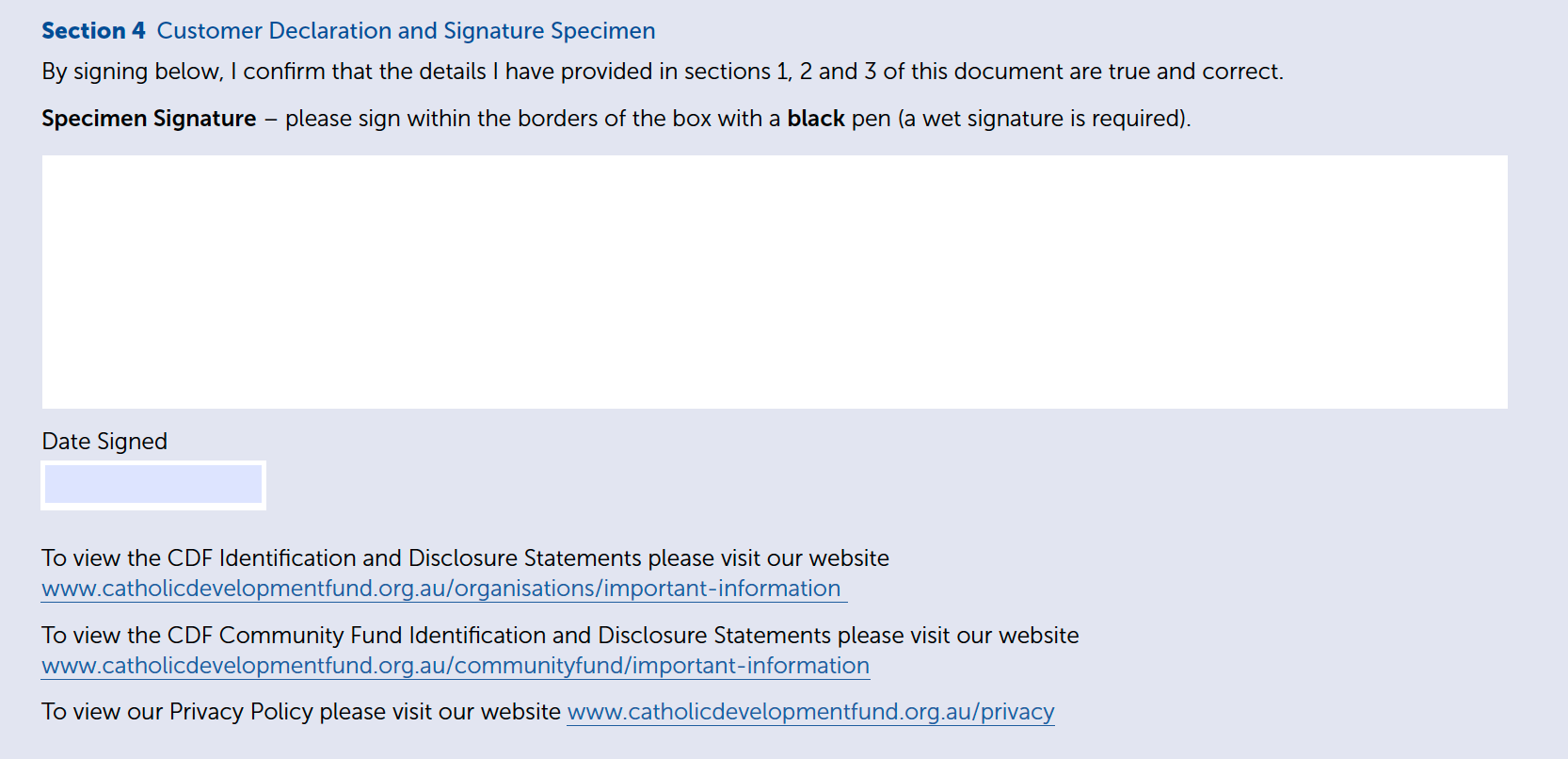

Step 4: Customer declaration and signature specimen

Important information

- Please sign this section with a black pen

- A physical “wet” signature is required

- CDF will not accept electronic signatures

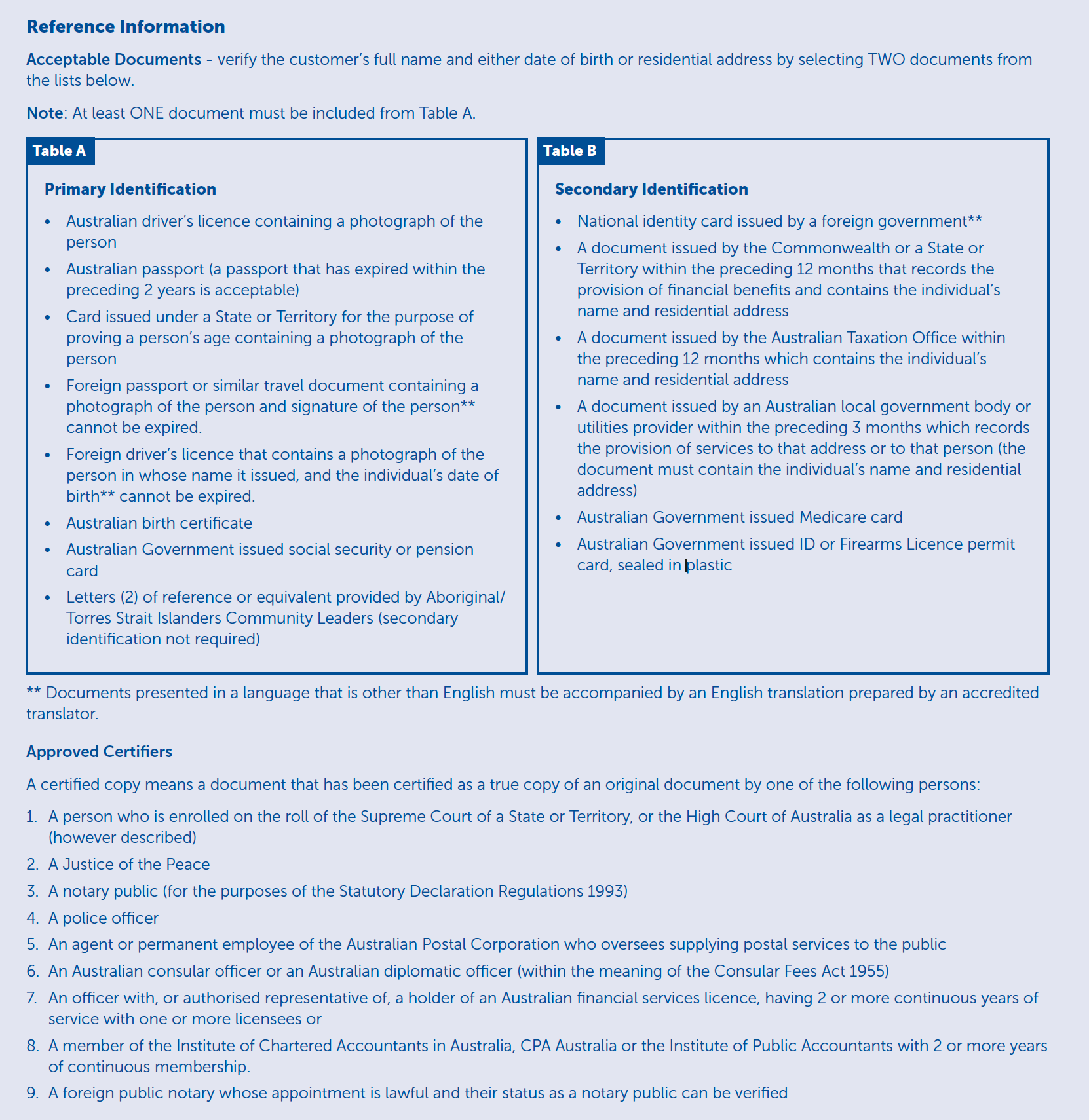

Reference information: Acceptable identification documents

Frequently Asked Questions

What is Electronic Verification of Identity?

CDF uses a secure third-party provider to electronically identify all individuals who apply for, or are being added as a signatory to, all accounts, investments, and loans. As part of the verification process, your name, address, and date of birth may be provided to a credit reporting body and reporting entities such as VIX Verify and Equifax, who will assess whether this matches the information held by them. They will use this information in addition to their own information to make the assessment. The issuer or official record holder of any document you provide may be contacted to verify them by using the Government’s Document Verification Service. This document check may involve an approved third-party service.CDF uses a secure third-party provider to electronically identify all individuals who apply for, or are being added as a signatory to, all accounts, investments, and loans. As part of the verification process, your name, address, and date of birth may be provided to a credit reporting body and reporting entities such as VIX Verify and Equifax, who will assess whether this matches the information held by them. They will use this information in addition to their own information to make the assessment. The issuer or official record holder of any document you provide may be contacted to verify them by using the Government’s Document Verification Service. This document check may involve an approved third-party service.

Why do I need to be identified by NAB?

CDF partners with the National Australia Bank (NAB) to provide our clients with a NAB Cheque “Link” Account – this provides account holders with access to the NAB branch network and a unique BSB and account number for each CDF cheque account. NAB requires all signatories to be fully identified, using a Certificate of Identity Form.