The battle against cybercriminals and their persistent efforts is more crucial than ever as cybercrime continues to rise each year in Australia, and in particular – phishing scams.

What is a phishing scam?

A phishing scam is a method of stealing confidential information by sending fraudulent messages to a victim. It is one of the most common cyber scams reported in Australia.

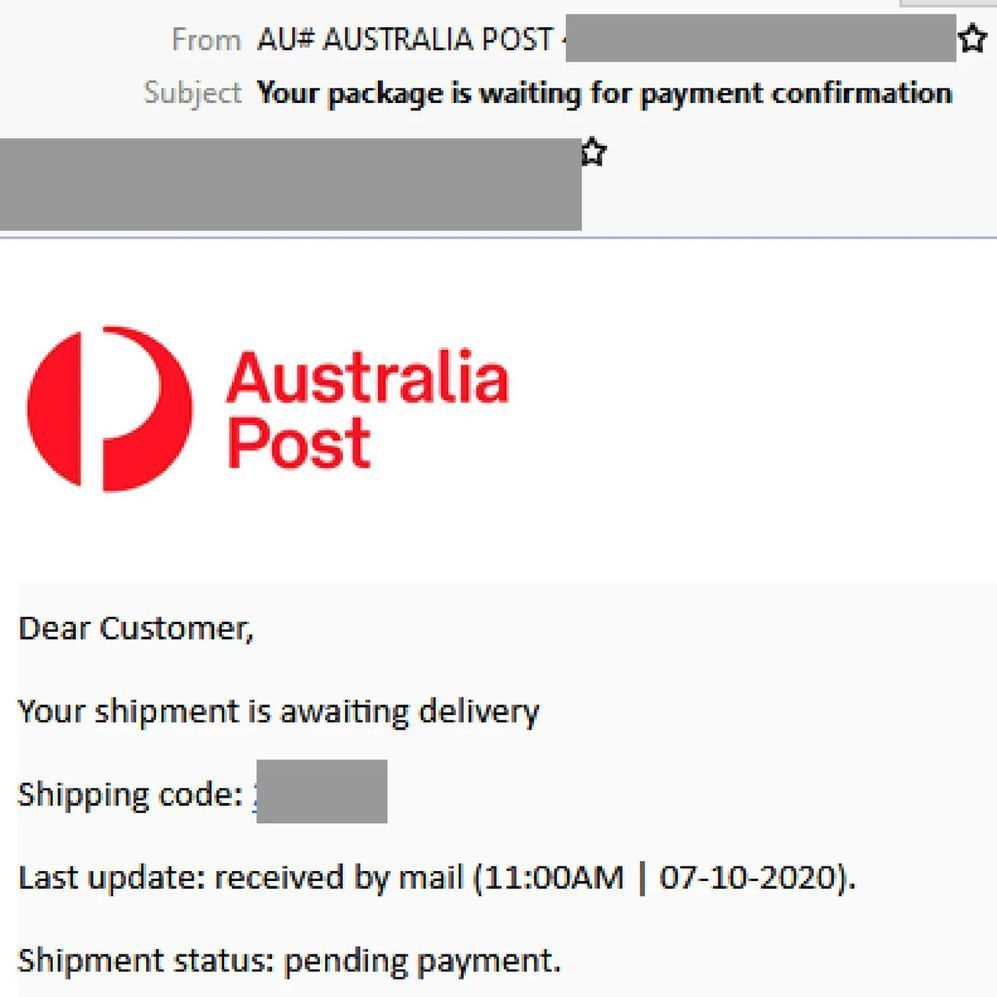

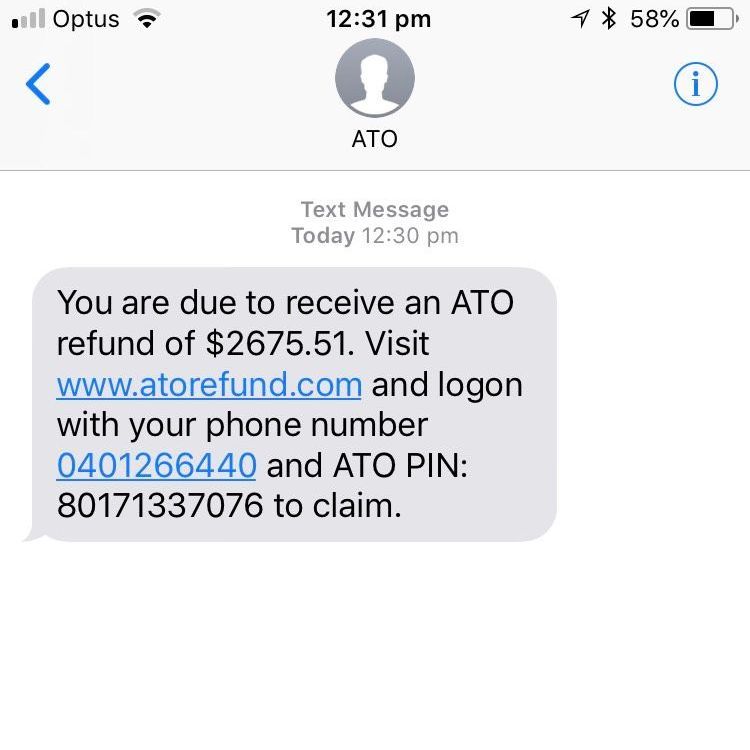

Perpetrators often disguise themselves as reputable organisations or even Government departments, exploiting people’s trust in these entities.

Phishing messages come in various forms, all designed to trick individuals into surrendering personal or business information. Examples include, email or system upgrade messages, HR emails from a similar address, website expiration messages requesting and emails with information relating to government benefits or financial assistance payments.

Where can I receive a phishing scam?

Phishing scams are versatile and can be delivered through multiple channels, including email, SMS, social media, instant messaging platforms, and even phone calls. At first glance, they often appear as a legitimate message from trusted sources. These messages often feature official-looking logos, disclaimers, and persuasive prompts, coercing individuals into disclosing sensitive and personal data, such as passwords and banking details.

The tactics employed by cybercriminals in phishing attempts includes sending malicious links or attachments, and even requesting a range of personal information, including usernames and passwords. Spotting these fraudulent messages can be tricky, as cybercriminals invest significant effort into making them appear genuine.

To help safeguard you and your business against phishing scams:

1. Exercise caution before clicking links

Whenever possible, hover your cursor over the link, but don’t click on it, to preview the actual web address it leads to. Check the web address for spelling errors or varying punctuality. Visit direct URLs instead of clicking links.

2. Never disclose personal information via message links

If you need to visit a website, such as your bank's portal, it is safest to manually enter the official web address into your browser. Alternatively, use a trusted search engine to find the official website and log in from there. Be vigilant for advertisements, as cybercriminals can create deceptive ads for fraudulent websites.

3. Verify the source of suspicious messages

If you receive a message that raises doubts, take the time to contact the person or business mentioned using legitimate contact details from a separate, reliable source. Do not rely on the contact information provided within the suspicious message.

For more information, visit:

- Australian Government – Australian Cyber Security Centre

- Australian Competition and Consumer Commission (ACCC) – Scamwatch

We’re here to help

Cyber-scams will always be prevalent in the online world; but by working together we can help detect and prevent suspicious activity.

If you think you’ve been a victim of a scam or are worried about the security of your accounts, contact us today.

Share this article:

Related articles

CDPF Limited, a company established by the Australian Catholic Bishops Conference, has indemnified the Catholic Development Fund ABN 15 274 943 760 (the Fund) against any liability arising out of a claim by investors in the Fund. In practice, this means your investment is backed by the assets of the Catholic Archdiocese of Melbourne. The Fund is required by law to make the following disclosure. Investment in the Fund is only intended to attract investors whose primary purpose for making their investment is to support the charitable purposes of the Fund. Investors’ funds will be used to generate a return to the Fund that will be applied to further the charitable works of the Archdiocese of Melbourne and the Dioceses of Sale and Bunbury. The Fund is not prudentially supervised by the Australian Prudential Regulation Authority nor has it been examined or approved by the Australian Securities and Investments Commission (ASIC). An investor in the Fund will not receive the benefit of the financial claims scheme or the depositor protection provisions in the Banking Act 1959 (Cth). The investments that the Fund offers are not subject to the usual protections for investors under the Corporations Act (Cth) or regulation by ASIC. Investors may be unable to get some or all of their money back when the investor expects or at all and investments in the Fund are not comparable to investments with banks, finance companies or fund managers. The Fund’s identification statement may be viewed here or by contacting the Fund. The Fund does not hold an Australian Financial Services Licence.